Are you interested to invest in gold? We will gladly explain which aspects you should pay attention to when investing in gold. Gold has performed well in recent years, delivering high returns. As inflation rates are going up and the economic developments are becoming less favorable, many investors choose to put their money in gold. Since 1825, we have been guiding our clients in buying, managing and selling precious metal.

During recent years, investing in gold has been much more profitable than expected. An average annual return on investment of 9% makes gold one of the best performing investments of the past two decades.

Investing in gold is a classic way of building wealth. During the past 50 years, the price of gold has – on average – risen 8% annually.

With the inflation (devaluation of money) rapidly on the rise, investing in gold investing in gold is becoming increasingly popular. More investors are looking for ways to protect their purchasing power. Throughout the years, gold has been offering this very protection.

Investing in physical gold or gold mining stocks?

Investing in gold could be done either by buying physical gold or buying gold mining stocks. The prices of gold mining stocks, however, are volatile and therefore a lot more risky than investing in physical gold.

One of the advantages of investing in physical gold, as opposed to gold mining stocks, is the fact that the ‘base case’ is clear cut. Supply and demand determine the price of physical gold. The price of gold mining stocks, on the other hand, is not only determined by the price of gold, but also by management quality, local rules and regulations, labor costs, energy costs and many other factors.

The majority of our customers buy gold with the aim of protecting their purchasing power. If this is your goal, then the choice for physical gold is an excellent one.

As stated above, supply and demand determine the price of gold. We will explain from which sectors the demand for gold mainly stems and which sectors ensure that there is sufficient supply. We will also look at the prime cost of gold.

Most of our customers are private individuals and entrepreneurs buying gold with the aim of protecting their purchasing power. The real interest (interest minus inflation) has been negative for over five years now, resulting in a value decrease of fiat money.

There are risks associated with investing in gold. The price of gold determines the value of your investment, and as any other investment it may go or down. Additionally, you will not be paid interest on gold holdings as you would with a savings account. Since interest rates are low now, you are not experiencing this disadvantage. Nevertheless, the price risk is continuous. If you invest in gold, you should take this into account.

A major advantage of investing in gold is that it could be liquidated quickly. In fact, you could easily sell it. After the sale, you will have the proceeds in your account within a few days.

Below we discuss the fundamentals of the gold market such as supply, demand and the cost price of gold.

The demand for gold mainly comes from the following sectors: jewelry, investors, central banks and the industry (manufacturing).

Of these four sectors, jewelry uses most of the gold supply. During the past decade, the manufacturing of jewelry accounted for some 51% of the demand for gold.

Investors in gold represent 30% of the demand for gold, of which the largest share was bought in gold bars.

Another 12% of the demand for gold stems from the central banks, while the manufacturing industry uses some 7%.

During the past decade, the average total demand amounted to 4,354 tons of gold annually.

Among other sources, gold is won from the recycling of waste consumer products. Recycled gold accounts for some 22% of the supply. Most gold, however, is produced in mines.

The four largest producers of gold through mining are China, Russia, Australia and the United States of America. Both China and Russia are responsible for 11% of the total of mined gold globally.

Australia is the third largest producer with 10% and America follows with 6% of the gold mining production. The Americans own the largest gold reserves in the world.

During the past decade, the entire supply of gold averaged 4666 tons annually.

In 2021, according to World Gold Council data, one troy ounce of gold valued around $1125.

This amount includes the costs of operating the gold mine, overhead costs and capital costs.

The WGC gathered data from nearly every gold mine on the planet.

The price of gold has risen over the past few years.

In 2016, the average price per troy ounce was around $850.

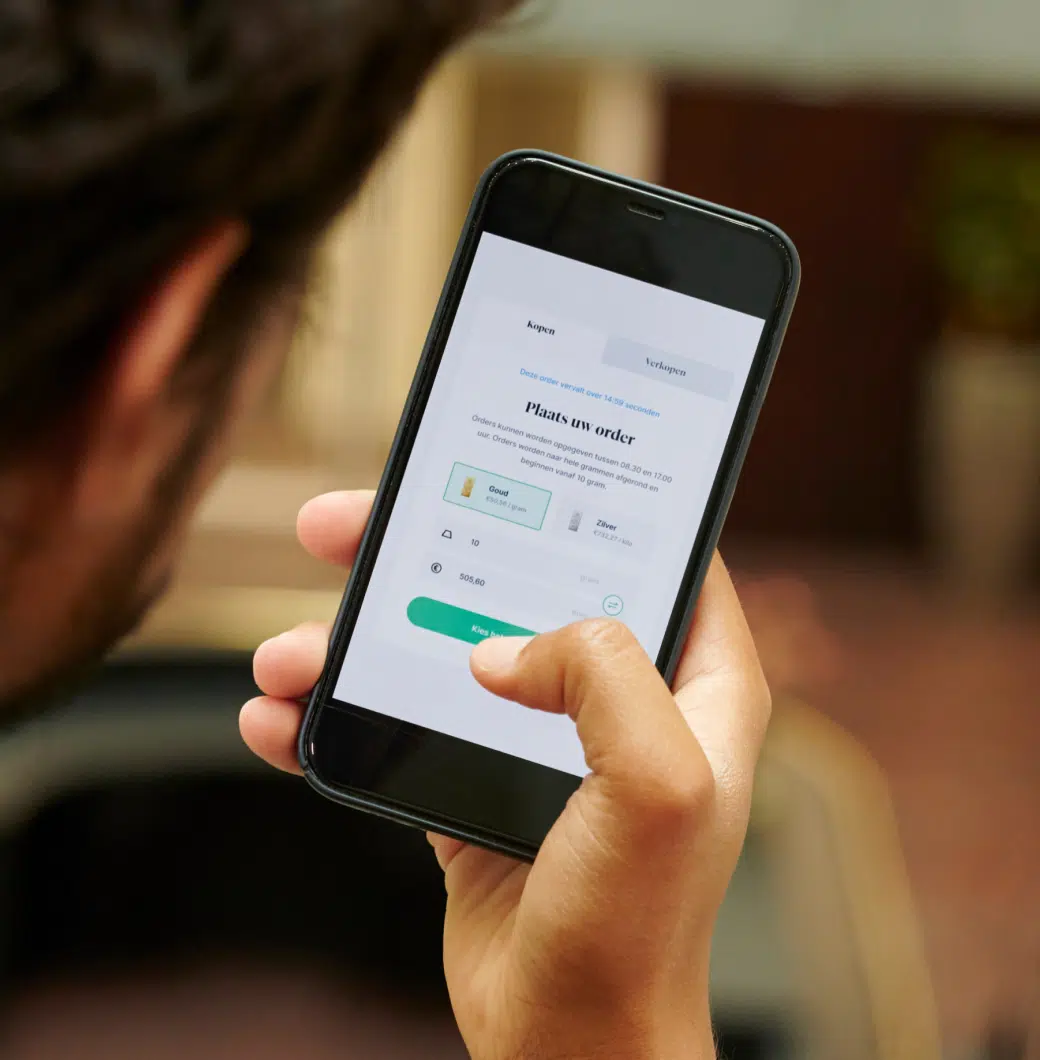

At DKgold you will have an account enabling you to invest in gold in an easy, safe and secure manner.

With this account you will buy physical gold, which will be stored under your name in one of the most secure vaults in the world.

You will be the legal owner of the gold bars. This is a very important aspect of the process, as this will exclude the risk of bankruptcy. This is an essential part of our service.

In your account you will find a so-called dashboard, through which you are able to follow the return of your investments live. Furthermore, from this dashboard you are able to easily download your annual financial statement in PDF-format.

DKgold is also your firm of choice if you are an entrepreneur and wish to invest in gold through your holding company. For that purpose you will open a business account with us. Learn more about corporate investment in precious metals.

DKgold is the specialist when it comes to investing in gold. More than 7,000 customers profit from our guidance and assistance. Our rates for buying, selling back and storage are the best in the market. You are also able to profit from our SALE, which offers the best rates in all of Europe!

But the main reason our clients have chosen DKgold is our reliability, discretion and accessibility. This is the soul of our organization.