Treasury yields hold precious metals in their grip

Gold prices surged Monday towards a monthly high reached during the Asian trading session, supported by a slight dollar pullback and prospects of the Fed taking a break from rate hikes later this year. In the short term, government bond yields will keep precious metals in their grip.

NFP data, Friday, showed that US job growth picked up in August, while unemployment rose to 3.8% and wage increases moderated. It seems that the current rate hike by the Fed is starting to trigger some sort of gradual easing in the US labor market, which could reduce high inflation expectations.

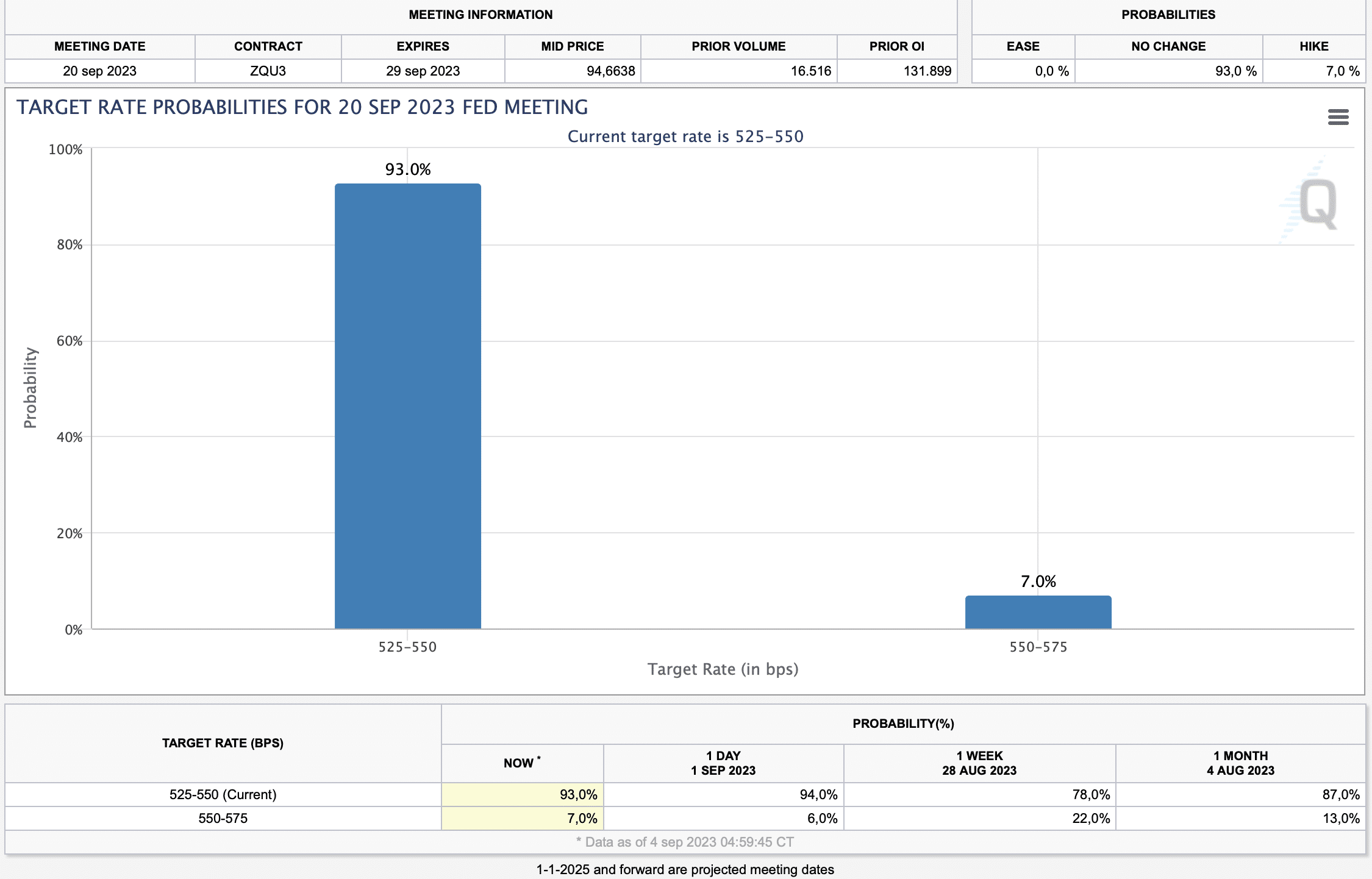

Traders now see a 93% chance of the Fed leaving rates unchanged at the next FOMC meeting in September, according to the CME FedWatch tool, and only 7% expect a further rate hike of 25 basis points.

Non Yielding versus yielding assets

Assets such as gold and silver do not yield interest (non-yielding assets), unlike government bonds, for example. As a result, non-yielding assets tend to lose their appeal if interest rates rise or remain high. Precious metals will depend on what happens to government bond yields leading up to the FOMC meeting scheduled for September 19-20.

Because we have been in an environment of high (core) inflation and quantitative easing and other purchasing programs from central banks in recent years, the money supply has increased enormously, which means that gold has a positive +6.45% YTD, despite the high interest rates. This inverse relationship does not always hold, and gold as a non-yielding asset has certainly not lost its appeal.

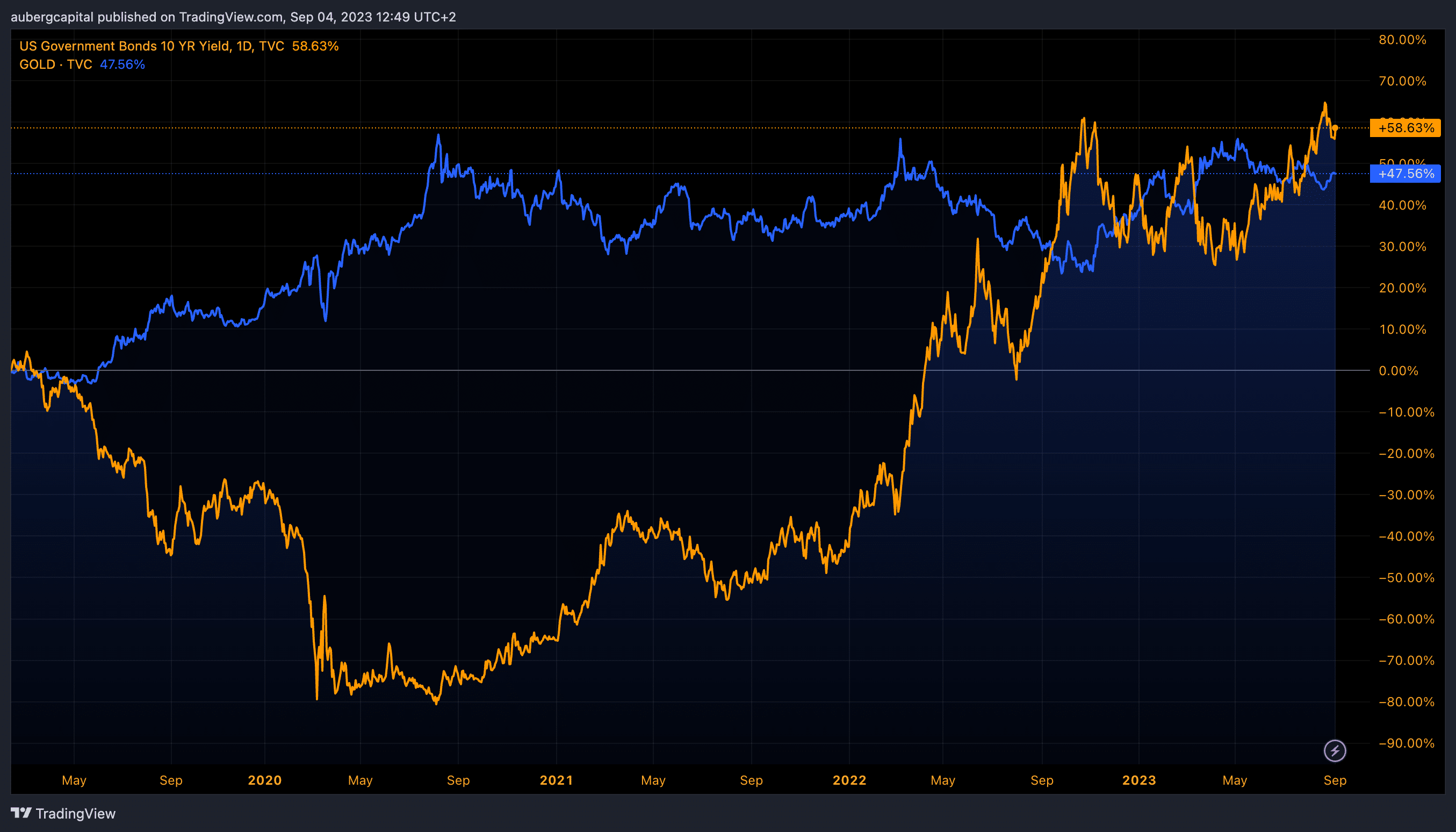

The inverse between gold and US 10-year rates

An important measure is the inverse relationship between gold and the yield on the US 10-year bond. (US 10YR = orange ; gold = blue). When interest rates fall, gold rises and usually vice versa.

If we zoom in on May 2019, we see that interest rates fell until mid-September 2020. During this period, gold generated a return of more than 50%. On the other hand, when interest rates started to rise from September 2020 to now, gold is almost equal in terms of returns.

This is why the ‘long awaited’ pivot (the possible reduction in interest rates) is very important for precious metals investors. The guarantee is there: it will come sooner or later, but when? That’s the multi-million dollar question.

Looking back at the scenario at the end of 2019, we saw both gold and silver take a significant upward sprint as 10-year yields took a nosedive. At a pivot, we will undoubtedly see the same scenario.

The yield on the US 10-year is currently 4.17%. If we see a fall in interest rates based on the tightened interest rate outlook, this would be a positive development for gold and silver.

Views based on published articles or news items are purely informative. The non-binding information should not be perceived as an offer, investment advice or any other financial service.

Sign up now for our newsletter and receive daily updates on precious metals, our discounts and articles.